Let's dig into the new Average Customer feature in Repeat Customer Insights a bit more.

(Even if you don't have the app, you might want to follow along as there's some advice you can steal from for your customer acquisition. You'll just have to calculate everything by hand)

Many customer acquisition formulas use your Average Order Value or Average Lifetime Value (LTV) to figure out how much you could spend to acquire a customer.

One common formula is to keep the cost to acquire a customer (CAC) to 1/3rd of the LTV. In other words, spending $1 should return $3 in customer spending. This gives you some buffer for overhead costs, returns/refunds, and other expenses. Other formulas will factor in profit margins or tweak the formulas to try to give a more precise number.

In the end they all boil down to: if you spend $X, then you should acquire a customer worth $Y, giving you a profit of $Z.

Do that over and over and your store will grow.

One problem is, how long will that take? Until the customer's buying lifetime is completed, you'd have earned less than their LTV from them. If their lifetime is two orders, 12 months apart, you'd need to make sure you make enough on the first order to pay the acquisition costs and keep the lights on for a full year. With long payback periods this can cause a cash problem where you have potential customer orders but no cash and need to pay bill today.

The Average Customer helps to solve these problems for you.

It has the Average LTV so you can plug that into most formulas. For others that use AOV instead, it also includes that metric.

Additionally it includes the Average Orders per Customer, Average Customer Purchase Latency, and Average Lifetime so you can understand how long it'll take for an average customer to come back and buy again.

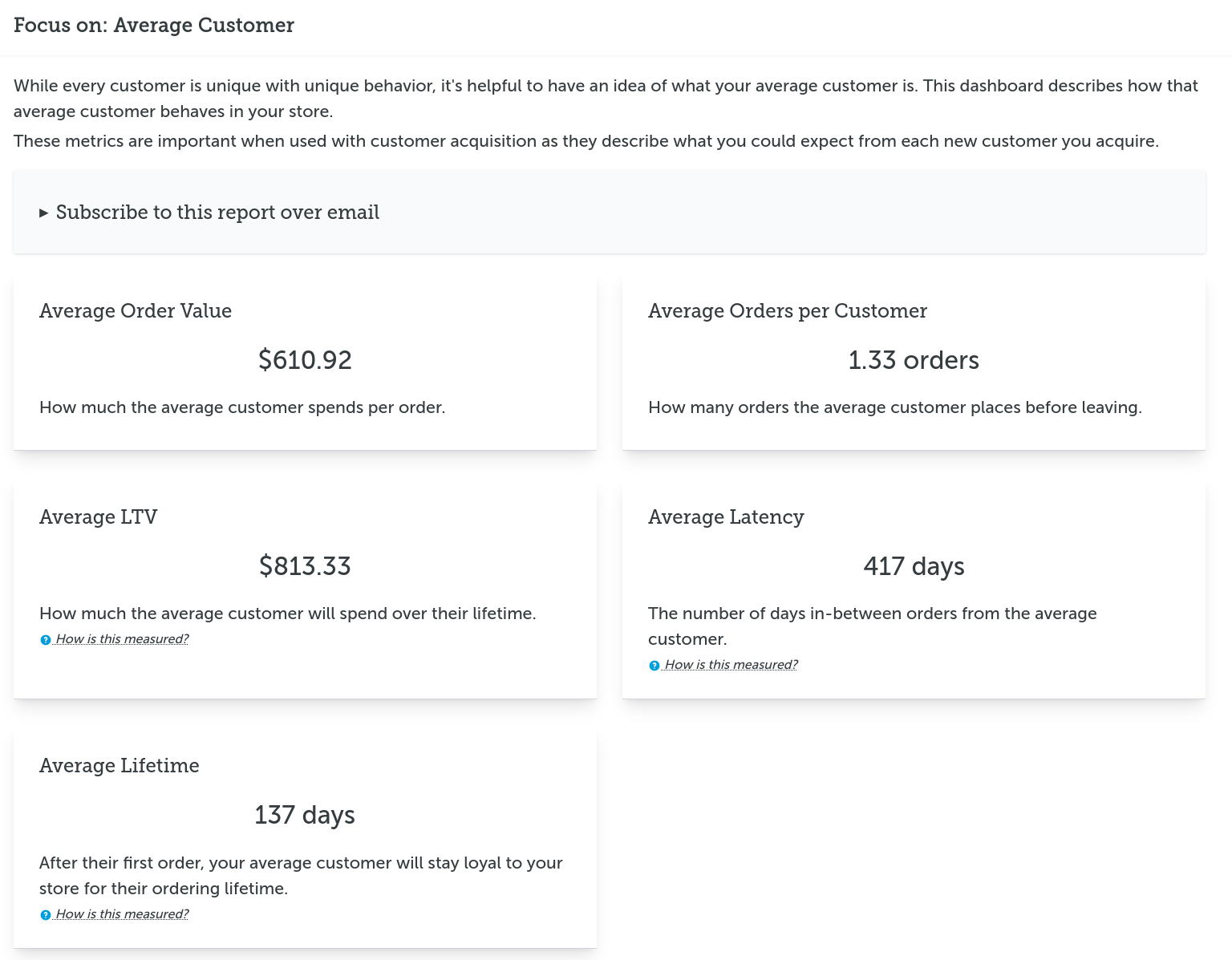

Let's use some actual numbers from the demo:

- Average Order Value $610.92

- Average LTV $813.33

- Average Orders per Customer 1.33

- Average Latency 417 days

- Average Lifetime 137 days

With these metrics and the 3:1 CAC formula we can learn a few things:

- Should limit acquisition spending to $271.11 (from Average LTV)

- The first order is likely to be large enough to cover acquisition costs, $610.92 (from Average Order Value)

- The remaining $200 from the customer's lifetime occurs in 1-in-3 customers (Average Orders per Customer is 1.33)

- That next order takes well over a year (417 days) so planning for it doesn't make sense

With this I'd be confident acquiring customers based on their first order only. That could be worth $610 but it would be better to figure out the profit margin to make sure. Repeat orders are rare enough they shouldn't be expected as part of acquisition. When they occur they can just be happy surprises.

Customer acquisition is one of the more important reasons to analyze your Average Customer. When used Average Customer can help you predict your costs and profit potential from those acquisitions.

Eric Davis

Which marketing tactics are attracting the best buyers?

By analyzing your customers, orders, and products, Repeat Customer Insights can help find which marketing tactics attract the best customers.